Why Understanding Kenyan Betting Taxes and Rules Matters

Kenya has one of the most active betting markets in Africa, supported by a young population, a strong football culture and easy access to mobile money. However, many bettors participate without fully understanding how betting taxes work or what rules shape the legal environment. This lack of clarity often leads to surprise deductions, disputes with operators or misunderstandings about what winnings a player is entitled to receive. Kenyan betting taxes and regulations are not optional guidelines. They are legally enforced obligations that impact every bettor and operator in the country.

Understanding the rules does more than protect your bankroll. It ensures that you bet responsibly and avoid unnecessary financial risks. Many players assume that the amount shown as potential winnings in a betting slip is exactly what they will receive, but tax laws in Kenya include mandatory deductions that must be taken before payouts. Others believe that using unlicensed betting sites is harmless, even though such platforms operate outside the law and can freeze withdrawals without consequence.

For bettors who want long term success and safe betting experiences, knowledge of taxes and regulations is just as important as understanding odds or match analysis. With clear expectations and awareness of how the system works, bettors can make informed decisions that align with both legal requirements and their financial goals.

The Legal Framework of Betting in Kenya

Betting in Kenya is regulated by a clear, formal legal structure overseen by the Betting Control and Licensing Board, commonly known as the BCLB. This regulatory authority is responsible for issuing licenses, monitoring operators, enforcing compliance and ensuring that betting companies follow national laws. Without a valid BCLB license, a betting platform is not legally allowed to operate within Kenya.

The regulation of betting covers several areas. First, operators must meet strict financial, security and procedural criteria to ensure transparency and protect consumers. Second, they must demonstrate the ability to manage player data securely and process transactions reliably. Third, operators must comply with the tax obligations imposed on betting companies, including taxes on stakes and excise duty.

For bettors, the presence of a strong regulator means that disputes can be handled professionally and that licensed betting platforms must follow clear rules regarding payouts, advertising practices and responsible gambling measures. Failure to comply can lead to suspension or revocation of licenses, and in extreme cases even criminal charges.

Licensed operators provide a safer environment because they are accountable to the BCLB and other government bodies. Unlicensed platforms, by contrast, operate outside legal oversight and offer no real protection for bettors. If something goes wrong, players have no legal recourse.

How the BCLB Enforces Compliance

The BCLB performs routine audits, reviews financial documentation and investigates complaints submitted by the public. Its mandate is to ensure that every licensed operator follows the rules related to player verification, payout processing, tax submission and advertising.

Operators who violate regulations face penalties such as fines, license suspension or permanent bans. Bettors benefit from this oversight because it ensures that operators behave responsibly, provide accurate information and maintain transparent business practices.

Licensed Operators vs Unlicensed Platforms

Betting with licensed operators means that your money, personal data and winnings are protected by law. Licensed platforms must submit tax payments and follow fair gaming standards.

Unlicensed sites operate without regulation. They may refuse withdrawals, alter odds unfairly or disappear without warning. Bettors using these platforms risk losing funds permanently and may also face legal issues for engaging with unregulated services.

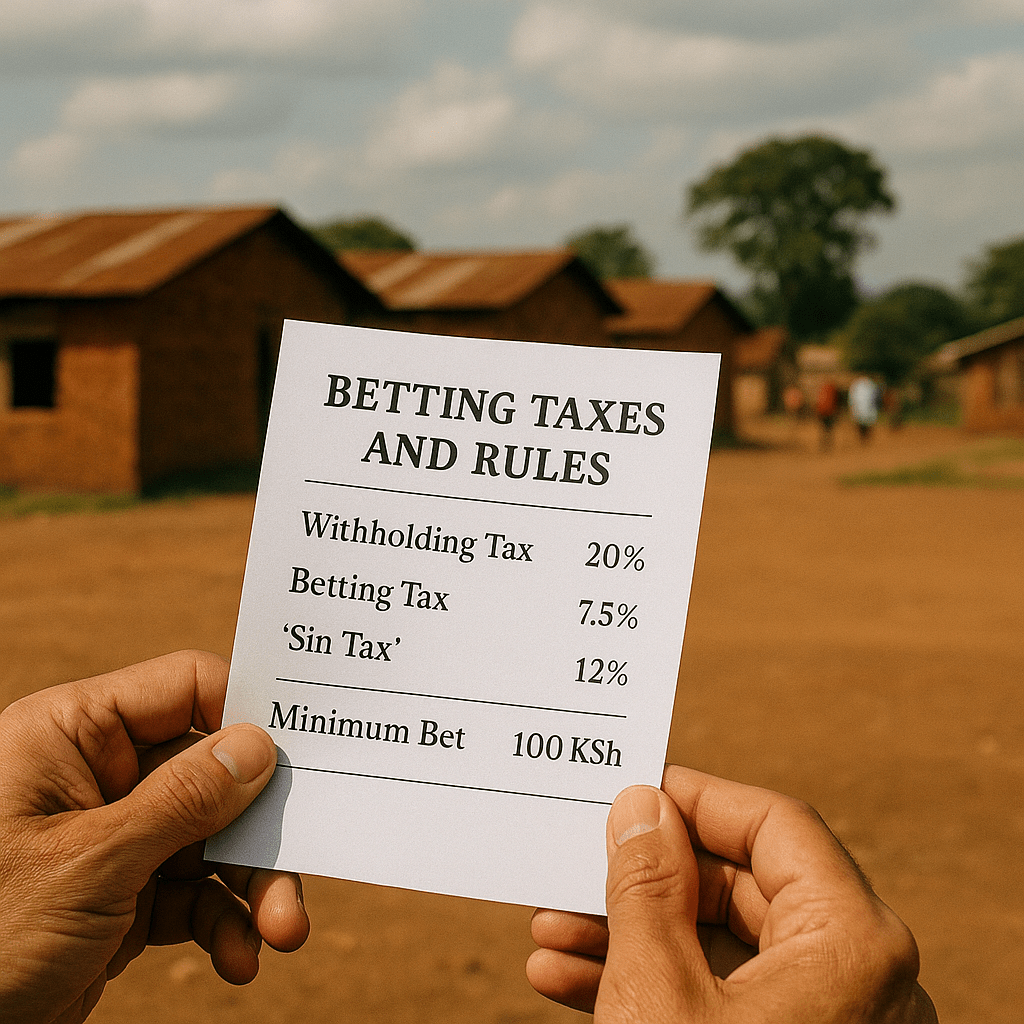

Kenyan Betting Taxes Explained

Taxes play a central role in betting in Kenya and they affect both operators and players. To navigate the system properly, bettors must understand how these taxes are calculated and deducted. Tax laws have changed several times in recent years, which is why many players are still unclear about the current structure.

Kenyan tax obligations apply at different stages of the betting process. There are taxes placed on betting stakes, taxes placed on operators and taxes applied directly to winnings. Bettors often focus only on the final payout, but the process involves multiple layers that determine the net amount received.

The most important tax for bettors is the withholding tax on winnings. This deduction is taken before the payout reaches the customer. Additionally, excise duty may apply to stakes or deposits depending on the operator. Even though bettors do not pay all the taxes directly, these charges influence the odds and the value of each bet.

Understanding these rules helps bettors forecast their real profit rather than relying on hypothetical amounts shown on the betting slip. It also prevents confusion when the payout appears lower than expected.

Tax on Winnings

The withholding tax is applied to any winning bet. The tax is deducted automatically by the betting operator before the payout is released. Bettors therefore receive only the net amount after tax. This system ensures compliance and prevents avoidance issues.

The withholding tax is calculated as a percentage of the winnings, not the stake. Bettors should always review their bet slip and payout confirmation to ensure the deduction matches the expected rate. Since operators must submit this tax to government authorities, it cannot be reversed or refunded.

Excise Duty and Other Charges

Excise duty is another important component of the Kenyan betting tax structure. Unlike withholding tax, which applies to winnings, excise duty may apply to the stake or to the transaction depending on the current legal framework. This duty increases the cost of placing bets even before any outcome is known. As a result, bettors need to account for this cost when planning their bankroll.

Operators are responsible for collecting excise duty and forwarding it to the Kenya Revenue Authority. Since operators incur additional taxes, many adjust their odds or business models to remain profitable. This means that although bettors do not directly pay all operator related taxes, they indirectly feel their impact through pricing, reduced bonuses or fewer promotions.

Other charges may also apply depending on government policies at the time. For example, taxation on betting companies may influence liquidity, promotional spending and overall market competitiveness. Understanding how these financial mechanisms work helps bettors interpret why odds differ among operators and why payout structures sometimes change unexpectedly.

How Taxes Affect Bettors and Their Bankroll

Taxes significantly influence how much profit bettors actually keep. Many players misjudge their potential returns because they calculate profits based on gross winnings instead of net winnings after tax. For example, if a bettor wins a certain amount, the withholding tax is deducted before they receive payment. This means the payout is always lower than the figure shown on the betting slip.

Excise duty also reduces the effective value of bets because it increases the cost of placing each wager. Bettors whose strategies depend on high volume betting must account for these charges to avoid eroding their bankroll through accumulated transaction costs.

When planning a bankroll, bettors must incorporate taxes into their calculations. A good rule of thumb is to evaluate expected returns based only on net payouts. This approach offers a more realistic view of profitability and helps bettors avoid chasing losses due to miscalculations. Bettors who ignore tax rules risk overspending or misunderstanding why their bankroll declines faster than expected.

Another important consideration is that taxes reduce the attractiveness of certain betting strategies. Systems that rely on marginal value or small profit increments become less effective when taxes cut into the payout. Therefore, bettors must adjust their methods to ensure that their strategies remain viable in the Kenyan betting environment.

Common Betting Rules Every Kenyan Player Should Know

Beyond taxes, bettors must comply with a set of rules established to protect both players and the integrity of the betting market. The most fundamental rule is that only individuals who are eighteen years or older may engage in betting activities. Operators must perform identity verification to ensure compliance, which is why bettors may be asked to submit documents before withdrawing funds.

Payment rules are another important area. Deposits and withdrawals typically require valid mobile money accounts registered under the bettor’s identity. Any mismatch can result in suspended transactions. This measure prevents fraud and strengthens financial accountability.

Betting limits are also applied by operators to prevent irresponsible gambling. These limits may include restrictions on maximum stakes, maximum payouts or frequency of wagers placed within a defined period. While some bettors view these limits as inconveniences, they exist to promote safer gambling behaviors.

In addition, dispute resolution is governed by strict procedures. Licensed platforms must allow bettors to file complaints and must cooperate with the BCLB for investigations. This ensures fairness and transparency in situations where payouts are disputed or system errors occur.

Understanding these rules helps bettors avoid unnecessary delays and complications. Compliance is not only a legal requirement, but also a way to ensure a smooth and secure betting experience.

Mistakes Bettors Make When Handling Taxes and Rules

One of the most common mistakes Kenyan bettors make is ignoring withholding tax details. Many players are surprised when their winnings are lower than expected, even though deductions are clearly required by law. Bettors who do not factor taxes into their expected profits often find themselves overspending or chasing losses.

Another mistake is assuming that taxes can be refunded under certain conditions. Withholding taxes are final and non refundable because operators submit them directly to government authorities.

A major risk is betting on unlicensed platforms. Some bettors choose unregulated sites to avoid perceived restrictions, but these platforms do not follow tax laws, do not offer legitimate consumer protection and may withhold winnings without consequences. Since unlicensed operators evade regulatory oversight, any dispute becomes impossible to resolve legally.

Bettors also misunderstand excise duty and how it affects their bankroll. Because the duty applies before results are known, it directly influences profitability. Ignoring this can lead to unrealistic expectations of long term returns.

Finally, some players fail to follow verification requirements and as a result face delayed withdrawals. Proper documentation is essential for compliance and smooth transactions.

Recognizing these mistakes allows bettors to correct their approach and maintain safer, more sustainable betting habits.

Conclusion: Understanding Kenyan Betting Taxes and Rules for Smarter Betting

Kenyan betting taxes and rules shape every aspect of the betting experience, from how much bettors receive in winnings to how operators manage their platforms. While taxes and regulations may seem complicated at first, they play an important role in creating a secure, accountable and transparent betting environment. Bettors who understand these rules have a clear advantage because they can calculate realistic profits, manage their bankroll effectively and avoid unnecessary disputes with operators.

A strong understanding of withholding tax, excise duty and general betting restrictions helps bettors make informed decisions based on net outcomes rather than assumptions. Knowing the rules around identity verification, payment processes and operator licensing also reduces the risk of fraud or lost funds. Ultimately, betting in Kenya is safest and most rewarding when bettors follow legal guidelines and choose licensed platforms.

The path to successful betting is not only about predicting match outcomes or understanding odds. It is also about navigating the legal and financial framework that governs the industry. When bettors respect this framework and incorporate tax awareness into their strategy, they become more disciplined and responsible players. With this approach, betting remains an enjoyable and sustainable activity rather than a risky financial burden.

Kenyan Betting Taxes and Rules FAQ

1. Are betting winnings in Kenya taxed

Yes. All betting winnings are subject to withholding tax, which is deducted by the operator before payouts.

2. Do bettors pay excise duty directly

No. Excise duty is collected by the operator, but it affects bettors indirectly by increasing the cost of placing bets.

3. Why is my payout lower than what I saw on the bet slip

Because withholding tax is deducted from winnings before the money is released to your account.

4. Can betting taxes be refunded

No. Withholding tax is final and submitted directly to government authorities, so it cannot be reversed.

5. Do betting rules apply to online betting as well

Yes. All operators, online or physical, must follow Kenyan regulations, verification requirements and tax laws.